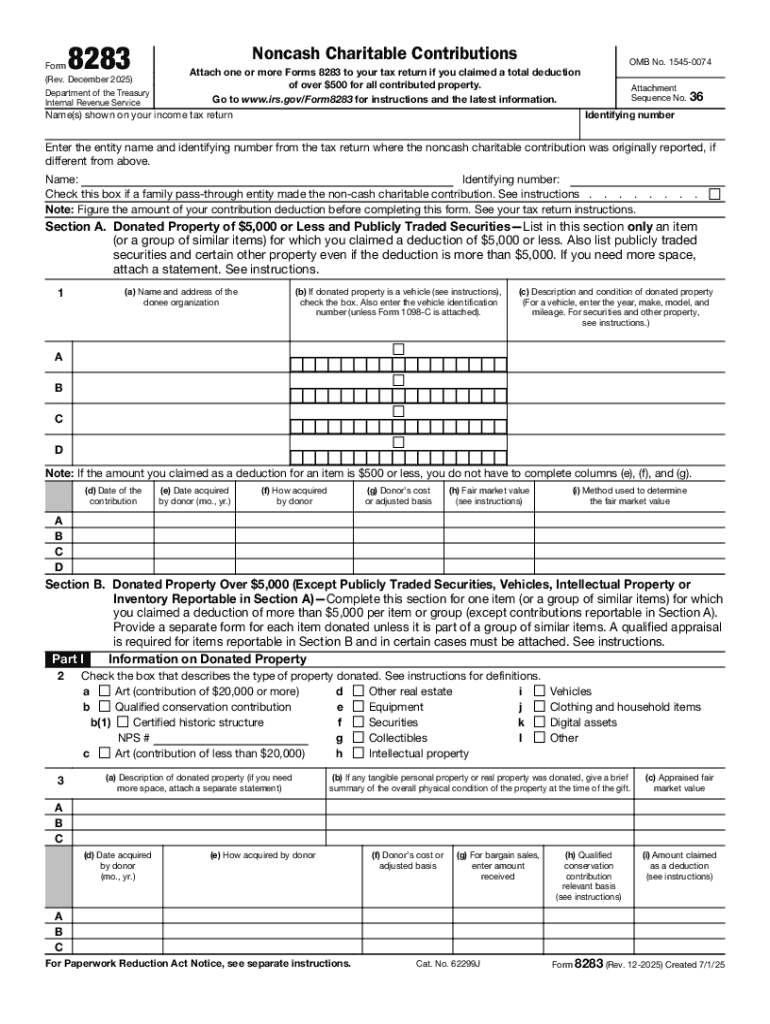

What is form 8283?

Form 8283 is a standard IRS report for taxpayers (individuals, partnerships, and C corporations) to declare noncash charitable donations.

Who should file form 8283?

The IRS form 8283 is used by individuals, partnerships, and business entities (C and S corporations).

Individuals, partnerships, and personal service corporations must complete and send their IRS form 8283 if the deduction amount for each non-cash donation is more than $500. C corporations must report the 8283 form only if the deduction they claim for such gifts exceeds $5000.

None of the taxpayers mentioned above should use this document to report out-of-pocket expenses for voluntary activities or contributions made with checks or credit cards. They are considered "cash contributions" and don't apply to form 8283.

What information do you need when you file form 8283?

Form 8283 consists of two sections to fill out depending on what you donated:

- Section A is for those who contributed property worth $5000 or less. You should list the donees and report in detail all items of the donated property. For a deduction claimed over $500, you should also specify the dates of the acquired items, their cost, and how you obtained them.

- Section B is required only if the cost of the donated property exceeds $5000. Here you should provide types of the contributed property, its description, market value, dates of acquisition, price, and how you obtained it.

The IRS form 8283 should also contain signatures of the donor, appraiser, and the authorized person of the donee.

Detailed form 8283 instructions are available on the IRS website at the following link:

https://www.irs.gov/pub/irs-pdf/i8283.pdf

Is form 8283 accompanied by other forms?

Partnerships and S corporations will inform you of your share and contributions with a copy of Schedule K-1 (form 1065 or 1120S). To determine your deduction, use the amount shown on Schedule K-1, not the one declared in form 8283.

How do I fill out form 8283?

Both paper-based and electronic 8283 form submissions are allowed. Here is how you can easily fill out and sign your report online in pdfFiller:

- Click Get Form to upload and open it in the editor.

- Use the built-in navigator with the Next key to complete all the necessary fields.

- Check your answers and place your signature in the related area.

- Click Done to finish editing.

- Use the Link to Fill option to send your document for signature to your appraiser and the donee representative, save your form 8283 on your device, or use one of the available file-sharing options.

When is form 8283 due?

Prepare and report your IRS form 8283 together with the annual tax return no later than April 15th. In 2022, the due date is April 18th.

Where do I send IRS form 8283?

Please mail your non-cash charitable contributions report to the IRS or submit it electronically at the IRS official website. You can email your tax form 8283 or request a mail delivery right from pdfFiller with its Send via USPS feature.